The past 2022 has seen many new breakthroughs and rapid developments in global cell therapy. 2022 is also the first year of commercialisation of CAR-T in a realistic sense. As the anti-epidemic landscape changes and the fever for new crown-related vaccines, test kits and other products fades, the pharmaceutical industry's attention once again returns to the time-honoured topic of oncology treatment. These two factors together have revitalised the CART industry, and good news after good news has followed. At the beginning of the New Year, Legendary Biologics has also brought good news about CAR-T.

Recently, Legendary Biologics announced that the Phase III open study of CAR-T therapy Carvykti (Ciltacabtagene autoleucel) for the second-line treatment of multiple myeloma met the primary endpoint of significant improvement in progression-free survival (PFS).

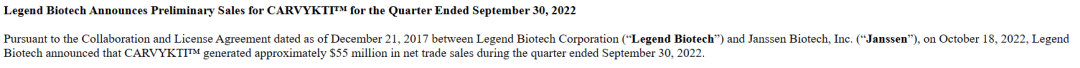

Carvykti debut report card

First year sales of US$134+ million

Carvykti, the first product approved for marketing by Legendary Biologics, is a genetically modified autologous T-cell immunotherapy against BCMA indicated for the treatment of adult patients with relapsed or refractory multiple myeloma who have undergone four or more lines of therapy, including proteasome inhibitors, immunomodulators and anti-CD38 monoclonal antibodies.

Carvykti is a heavyweight product line for Legendary Biologics. Carvykti was approved for marketing by the FDA in February 2022 and received conditional marketing approval in the EU in May. As the 2nd BCMA CAR-T, Carvykti is priced at $465,000. on January 24, 2023, Legendary Biologics announced sales of $55 million for Carvykti in the fourth quarter of 2022, unchanged from the third quarter.

Based on previously disclosed sales data, Carvykti generated net trade sales of approximately $24 million in the second quarter and $55 million in the third quarter for the period ended June 30, 2022. As a result, Carvykti's total sales for the first year (nine months in total) amounted to $134 million.

8 CAR-T products launched

Carvykti and Abecma compete for the BCMA target

Globally, CAR-T has become the focus of academic and industry attention since 2021. There are currently eight CAR-T products on the market worldwide. A number of companies at home and abroad, such as Xinda Bio/ Reindeer Bio and Keji Bio/ Huadong Medicine, are also laying out the development of BCMA CAR-T therapies.

In addition to Carvykti, BMS and Blue Bird have jointly developed Abecma, the first approved BCMA CAR-T therapy priced at nearly US$440,000, which is a strong rival to Carvykti and has a first-mover advantage, with sales of US$156 million in the first half of 2022 alone. up 550% year-on-year. In the third quarter, sales were up to US$107 million, placing it firmly in the top spot in the BCMA CAR-T market.

In terms of sales, Carvykti, a latecomer to the market, has performed well and is a good start to 2022. Abecma, the leader in BCMA CAR-T, has not been affected by the loss of market share to Carvykti, despite the fact that it has achieved solid sales figures.

Six CD19-targeted CAR-T products with varying success

The other six marketed CAR-T products targeting CD19 include Kymriah, Yescarta, Breyanzi, Yikki Lirense Injection and Ruiji Orensei Injection, etc. Domestic and international companies such as Allogene and Hengrun Dasheng Bio have also joined the CD19 lineup.

Kymriah and Yescarta, both approved in 2017, are the "oldest" products in the CAR-T sector, with H1 2022 results of US$263 million and US$506 million respectively. Of these, Kymriah from Novartis was down nearly 12% compared to sales of $298 million in the same period last year, while Yescarta from Gilead was up nearly 50% compared to sales of $338 million in the same period last year, proving that the acquisition of Kite to join the CAR-T track was money well spent.

According to its Q3 2022 results, Breyanzi achieved sales of US$127 million in the first three quarters of the year, but BMS still has high hopes for Breyanzi, which is also seen as one of the five drugs that will provide a significant contribution to BMS sales over the next two years and is expected to achieve revenues of over US$3 billion in 2029.

Also of interest are the three CAR-T products that are gradually starting to make their mark.

In June 2021, FosunKite's Yikilenxai injection was approved for marketing, the first CAR-T therapy to be marketed. on 1 September 2021, the CAR-T product Regiolenxai injection (trade name: Benodar), manufactured by WuXi Juno, was approved for marketing by the Drug Administration. Both are priced at $1.2 million and $1.29 million respectively, which are far lower than similar products in other countries, but are also astronomically priced drugs. According to WuXi Juno's performance report, Benodar's sales in the first half of 2022 were approximately RMB 66.07 million. on 14 December 2022, Hoyuan Biologics indicated that the marketing application submitted by the company for the CAR-T product Herkiransai Injection (proposed) was accepted by the CDE, and if approved for marketing, Herkiransai Injection may become the third CD19 CAR-T.

In summary, the performance of the CAR-T players in this arena is a mixed bag, but it also reflects that there are more possibilities for CAR-T.

Overall, there is some variation in the pace of sales leadership between the BCMA CAR-T and CD19 CAR-T arms in 2022, with CD19 CAR-T gaining a slight edge due to its slightly broader indications.

However, looking at the sales performance of the above-mentioned CAR-T therapies, compared to the star products of major pharmaceutical companies, the performance of CAR-T products is not very impressive, and the high price is a constraint. Therefore, it is important to give full play to the advantages of the products and break the unpromising CAR-T prospect. It is expected that there will be more breakthroughs in the later stages of the research and development process, which will bring more room for price reductions and reduce the financial burden for patients and truly benefit them.